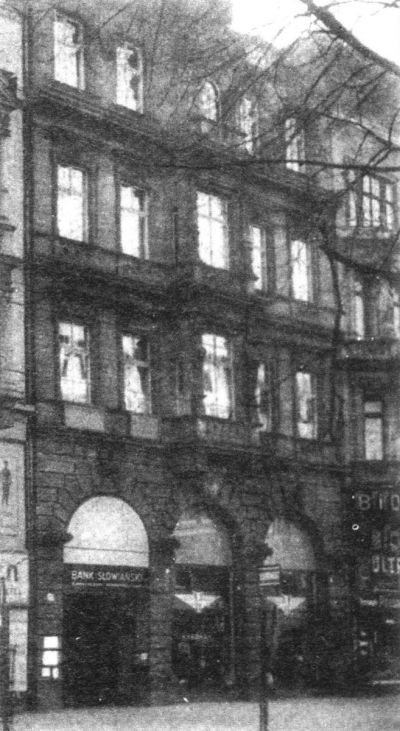

The Slavic Bank

The bank was set up on 8th February 1933 by a credit cooperative which was organised in the “Union of Polish Cooperatives in Germany” (Związek Spółdzielni Polskich w Niemczech). Start capital amounted to 150,000 RM, and was raised to 500,000 RM in 1937. The patron of the bank was Pastor Bolesław Domański. The bank conducted the usual business associated with a credit institute: giving credit and handling financial transactions. 90% of the credit was given to cooperative banks and agrarian trading companies, which borrowed money to be able to purchase artificial fertilisers and seeds. The Bank also financed many different activities undertaken by Polish organisations in Germany. It possessed a variety of real estate, including the student boarding school building in Breslau (Wrocław), a house in Opole on Nikolaistraße, a house and a piece of land in the village of St. Anne’s Mountain (Góra św. Anny), building land for the girls’ grammar school in Racibórz, and the Polish grammar school building in Marienwerder (Kwidzyń). In February 1940 the Nazi regime dissolved the Slavic Bank and confiscated its assets. After the Second World War the “Union of Poles in Germany” succeeded in recovering only a part of the assets. Even today some Poles in Germany are demanding that an enquiry be opened once more to fix an appropriate level of compensation.

The history of Polish banks in Germany goes back as far as the turn of the 20th century. The first financial institutes were set up in Silesia and Eastern Prussia. They had a cooperative character and were intended to support Polish agriculture. In addition they were mean to improve communication between Polish farmers and the banking system. Thus Polish banks in Germany fulfilled two closely related functions – business and national – which remained valid over the next few decades.

From the very start the organisation and business activities of Polish banks in Germany was intimately linked with the Poznan Bank, the “Bank Przemysłowców” (Industry Bank) and the “Bank Spółek Zarobkowych”, (Social Acquisition Bank). Above all there were two types of bank which enjoyed great popularity in Germany: the “Bank Ludowy” (People’s Bank) and the “Rolnik” (Farmer). The former was similar to the Industry Bank in Poznan. It was set up in 1861 and their organisations were closely connected. The “Rolnik” was set up in agrarian regions. Its duties included advising farmers on how to purchase cereals and sell produce necessary for agrarian production (artificial fertilisers, seeds, heating material etc.) The first “Rolnik” Bank was set up in 1906 in Złotów. Other branch-specific banks were also set up in Germany. These included construction and consumption cooperatives. That said, they did not survive the First World War.

The end of the First World War marked an important break in the growth of banking cooperatives. In 1918 27 Polish cooperatives had survived in Germany. Reorganisations were necessary as a result of the creation of Poland and drawing new border lines. Poznan no longer played the central role as a headquarters for finance and organisation. Political (the plebiscite and the Silesian uprising), economic (inflation) and personal (the return of Polish bankers to Poland) factors all influenced the development of the cooperatives. In this period we should particularly note the achievements of the “Bank Rabotników” (Workers’ Bank) in Bochum, which was set up in 1917. After all the branches of the Poznan Bank in Westphalia were closed down it took over responsibility for cooperative activities and financial transactions. The bank enjoyed many years of impressive growth in the following years. In 1920 it had access to cash reserves of 115,000 Marks, and had seven branches in the Ruhrgebiet (in Castrop, Wanne, Dortmund, Hamborn-Marxloh, Herne, Horst-Emscher and Recklinghausen). In addition it had a branch in the Netherlands, one in Katowice and one in Toruń. The bank financed Polish cultural activities and the educational system where its credit was used to finance Polish lessons. The swift growth of the Bank slowed down in the mid 1920s due to emigration to Poland and the withdrawal of deposits. Because it had little or no income now the bank reduced its activities from year to year, something which reduced its importance accordingly.

Economic difficulties at the end of the First World War had a considerable influence on the branches of Polish banks in Germany. It became necessary to improve coordination. A conference of the “Union of Poles in Germany” took place in July 1924. Its main theme was the problem of cooperatives. A decision was taken to set up a business commission at the “Union of Poles in Germany”, whose duties would include the supervision, coordination and support of Polish branch banks. Such steps were necessary because the Germans had simultaneously started an “emergency programme” aimed at helping farmers modernise their agricultural activities in the east. The farmers were given a choice between taking German aid and withdrawing from Polish banks, or being exposed to political and business chicanery. On 25th June 1927 the works council of the “Union of Poles in Germany” organised a meeting in Opole of all the cooperatives operating in Germany, where it was decided to spread the activities of the “League of Silesian Cooperatives” to the remaining existing Polish institutes in Germany. They also received material and legal help. All in all this amounted to around 15 banks and agrarian banks from all over Germany. The League now consisted of 22 credit cooperatives, four agrarian business institutes and others. Its chairman was Pastor Bolesław Domański. The changes had a positive influence on the Polish banks in Germany. They were also the precondition for working alongside banks in Poland. The “Union of Poles in Germany” put forward an application for revision, but consent was only given in 1935.

The second half of the 1920s was a time of relatively rapid growth for Polish banking cooperatives which had business and national duties alike. The banks introduced educational measures for farmers, as well as giving them legal and business advice. They also provided credit to Polish organisations and institutions. These organisations often held meetings in the banks’ rooms. The motto of the cooperatives was: “Use Cooperatives to Achieve Business Independence”. Competition and rivalry also existed amongst the Polish banks. This was above all clear in the case of the Silesian institutes and in western Germany. New legal entities were set up. In 1931 a new bank called “Unia” (Union) was founded to support the Polish educational system (schools, youth clubs, young people’s publications and other activities involving young people). The “Union of Poles in Germany” was responsible for deciding on the amount of credit involved.

On 9th January 1933 there was a meeting in Berlin of all the Polish banking cooperatives in Germany where it was decided to set up a “Central Bank of Polish Cooperatives in Germany” (the “Slavic Bank AG”, for short). One month later, on 8th February 1933, its constituent assembly took place. The start capital amounted to 150,000 RM, and in June 1937 this was raised to 500,000 RM. Its patron was Pastor Bolesław Domański and its elected director, Franciszek Lemańczyk. “The main duty of the bank” – according to a newspaper article in the “Dziennik Berliński” dated 1st June 1933 – is to centralise all the interests of the credit companies, something which had hitherto been hindered by the lack of contact between the cooperatives”. The shareholders of the “Slavic Bank” were cooperatives organised in the “League of Polish Cooperatives in Germany”. One year after the setting up of the Central Bank its work met with a very positive response. In his résumé of its activities the chairman of the Central Bank, Pastor Bolesław Domański said that: “On several occasions it has contributed to saving endangered cooperatives, and also rationalising the whole of cooperative business”. In June 1937 there was a general assembly of the Slavic Bank. The final general assembly took place on 27th April 1938, a few months before the outbreak of the Second World War.

The deterioration in German-Polish relationships had a considerable influence on Polish financial institutes. The German regime strongly decreased their ability to purchase real estate and sell land and building plots. This problem was a subject of much discussion at the final meeting of the “League of Polish Cooperatives in Germany” which took place in Breslau (Wrocław) on the 15th December 1938.

The Polish banks possessed a great deal of real estate which they put at people’s disposal for meetings and celebrations. They also took an active part in organising Polish life in Germany, including giving credit to finance the construction of school buildings. For example the “Pomoc” (Aid) bank financed the first Polish grammar school in Bytom; and the school equipment was financed from credit given by the Workers’ Bank in Bytom in 1932. The Slavic Bank was the owner of the student boarding school in Breslau (the administrative and editorial teams of the journal “Młody i Mały Polak w Niemczech” (Young and Small Poles in Germany) worked in its rooms. The Slavic Bank also owned the grammar school in Marienwerder (Kwidzyń), the building land in Racibórz on which the girls’ grammar school was to be built.

On 27th February 1940, following a “Decree on the Organisation of Polish People’s Groups in the German Reich”, all Polish organisations and activities, including those of banking cooperatives, were banned and their assets confiscated. After the Second World War the “Union of Poles in Germany” attempted to get the assets restored and applied for compensation. It was only partially successful. The problem of restitution of the confiscated property is still a subject of controversial discussion today.

Krzysztof Ruchniewicz, June 2014